When you pick up a prescription, you might assume your insurance covers it - but what if it doesn’t? Or what if your $50 copay suddenly jumps to $1,200? The answer lies in something most people never check: your insurance formulary.

A formulary is just a list. But it’s not a simple catalog. It’s a living, changing rulebook that decides which drugs your plan will pay for, how much you’ll pay out of pocket, and whether your doctor’s prescribed medication gets replaced by a cheaper alternative without your knowledge. This isn’t just paperwork - it’s the hidden system that controls access to your treatment.

How Formularies Work: The Tier System

Every insurance plan organizes drugs into tiers. Think of it like a pricing ladder. The lower the tier, the less you pay. Most plans use four tiers:

- Tier 1: Generic drugs. These cost the least - usually $10 to $15 per prescription.

- Tier 2: Preferred brand-name drugs. These are the ones insurers encourage. Copays range from $40 to $50.

- Tier 3: Non-preferred brand-name drugs. These are more expensive. You’ll pay $70 to $100 or more.

- Tier 4: Specialty drugs. These are high-cost medications - often for cancer, MS, or rare diseases. You might pay 33% of the full price. That could mean $1,000 a month or more.

The jump between tiers isn’t small. Moving from Tier 1 to Tier 4 can triple or even quadruple your out-of-pocket cost. A 2023 GoodRx survey found that 68% of people experienced a formulary-related cost shock in the past year. One Reddit user described how their Humira prescription moved from Tier 2 to Tier 4 overnight - their monthly cost went from $45 to $1,200.

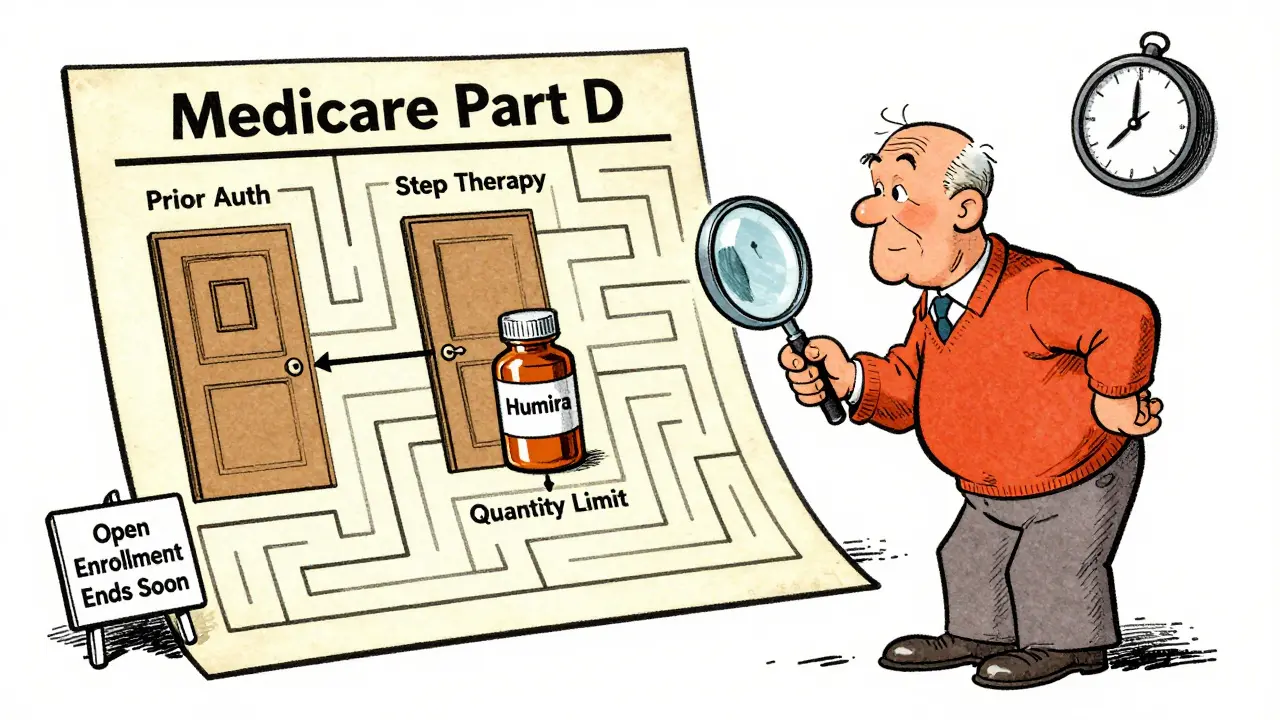

What Gets Blocked: Prior Authorization, Step Therapy, and Quantity Limits

Even if a drug is on the formulary, your plan might still block it. Three rules are commonly used:

- Prior Authorization: Your doctor must get approval from your insurer before you can get the drug. This can take days or weeks. The American Medical Association reports that 82% of doctors have seen delays that led to serious patient harm.

- Step Therapy: You have to try cheaper drugs first - even if they didn’t work for you before. If your doctor says you need a specific medication, but your plan says you must try a different one first, you’re stuck in a cycle of trial and error.

- Quantity Limits: Your plan may only cover a certain number of pills per month. Need a 90-day supply? You might have to pay extra or go through extra paperwork.

These restrictions aren’t random. They’re designed to save money - but they often delay care. For someone with a chronic condition like rheumatoid arthritis or multiple sclerosis, waiting weeks for approval can mean worsening symptoms.

Open vs. Closed Formularies: What’s the Difference?

Not all plans are built the same. There are three main types:

- Closed formularies: Only cover drugs on the approved list. If your medication isn’t on it, you pay full price. About 65% of Medicare Part D plans use this model. They keep premiums low - but limit choice.

- Open formularies: Cover almost all drugs. But they come with higher monthly premiums - often $18 to $22 more than closed plans. These are rare, making up only 22% of Medicare plans.

- Partially closed: A middle ground. They exclude certain drugs based on cost or clinical guidelines.

The trade-off is simple: lower premiums mean less freedom. Higher premiums mean more options. But most people don’t realize this until they’re denied coverage.

Therapeutic Substitution: When Your Pharmacist Replaces Your Drug

Here’s something most patients don’t know: your pharmacist can legally swap your prescribed drug for another - without telling you.

Thirty-one states have laws allowing pharmacists to substitute a lower-cost drug within the same therapeutic class. For example, if your doctor prescribes one statin for cholesterol, the pharmacist can give you a different one - even if you’ve been on the original for years.

This happens in about 18% of prescriptions, according to the American Journal of Managed Care. For most people, it’s fine. But for patients with complex conditions - like epilepsy, heart failure, or autoimmune diseases - even small changes can trigger side effects, flare-ups, or hospital visits.

One patient on Trustpilot wrote: "My insurance changed my medication without my doctor’s approval. I had a seizure because the new one didn’t work the same."

How Formularies Are Controlled: PBMs and Rebates

Who decides which drugs go on the formulary? It’s not your doctor. It’s not your insurer directly. It’s Pharmacy Benefit Managers (PBMs) - hidden middlemen.

Companies like CVS Caremark, Express Scripts, and OptumRx manage formularies for 92% of commercially insured Americans. They negotiate rebates with drug makers. The bigger the rebate, the higher the tier the drug gets.

That means a drug might be placed in Tier 2 not because it’s the best for you - but because the manufacturer paid a 40% rebate. A 2023 MMIT Network analysis found the same drug could be in Tier 2 on one plan and Tier 3 on another - simply because of rebate deals.

These deals drive up list prices. The drug you’re prescribed might cost $10,000 - but after rebates, the insurer pays $6,000. You still pay based on the $10,000 price. That’s why out-of-pocket costs are so high.

Real-World Consequences: When Formularies Hurt Patients

It’s not just about money. It’s about health.

A 2022 Health Affairs study by Dr. Peter Bach found that formulary restrictions on cancer drugs created "unacceptable barriers". One patient on Imbruvica - a leukemia drug - paid $15,000 a year out of pocket because it was in Tier 4. Many skipped doses. Some stopped treatment entirely.

GoodRx’s 2023 survey found:

- 42% skipped doses because of cost

- 29% switched to less effective drugs

- 18% abandoned treatment altogether

And when you request an exception - a formal appeal to get a non-formulary drug covered - only 38.5% of urgent requests are approved. The process takes days. For someone with a life-threatening condition, that’s too long.

What You Can Do: Protect Yourself

You can’t control the formulary. But you can control how you respond.

- Check your formulary every year. During open enrollment (October 15-December 7 for Medicare, November 1-January 15 for ACA plans), review every medication you take. Don’t assume your current plan still covers it.

- Use the Medicare Plan Finder or your insurer’s online tool. These let you enter your drugs and see exact costs. Users who compare three plans save an average of $472 a year.

- Ask your doctor about alternatives. If your drug is in Tier 4, ask if a similar drug in Tier 2 is an option. Sometimes, the difference is minimal clinically.

- Know your state’s substitution laws. If you live in a state that allows pharmacist substitution, ask your doctor to write "Do Not Substitute" on your prescription.

- Document everything. If your drug is removed from the formulary or your copay jumps, save your explanation of benefits. You may need it for an exception request.

And if you’re denied coverage? File an exception. CMS data shows 73.2% of requests are approved. But you have to ask. And you have to act fast.

The Future: What’s Changing in 2025 and Beyond

The system is changing - slowly.

Starting January 1, 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 a year. That’s a game-changer. Insurers are already restructuring tiers to comply.

By 2026, all Part D plans must show real-time drug costs at the point of prescribing. That means your doctor will see your copay before writing the script.

Some plans are experimenting with "digital formularies" - covering apps and digital therapies as part of treatment. Others are tying copays to outcomes: if your diabetes drug lowers your HbA1c below 7.0%, your copay drops.

But the core problem remains: formularies are designed to save money - not to make care easier. Until that changes, patients will keep paying the price.

What’s the difference between a formulary and a drug list?

There’s no difference - "formulary" and "drug list" mean the same thing. It’s the official list of medications your insurance plan covers. But "formulary" is the industry term used by insurers, pharmacies, and regulators.

Can my insurance drop a drug from the formulary without telling me?

Yes. While insurers must notify you if they change your plan’s formulary during the year, they’re not required to contact you individually. Many people only find out when they go to fill a prescription and are told it’s no longer covered. That’s why checking your formulary during open enrollment is critical.

Why do some drugs cost more even if they’re the same class?

It’s not about effectiveness - it’s about rebates. Drug manufacturers pay PBMs (Pharmacy Benefit Managers) to get their drugs placed in lower tiers. The higher the rebate, the better the tier. So two drugs that work the same way can have wildly different costs because one manufacturer paid more.

Can I fight a formulary decision?

Yes. You can request a formulary exception through your insurer. Your doctor must submit medical records supporting why you need the specific drug. Approval rates are high - 73.2% for Medicare Part D - but you must act. Don’t wait until you run out of medication.

Are biosimilars covered the same as brand-name drugs?

CMS requires Medicare Part D plans to cover biosimilars in the same tier as their reference drug. But only 61% of private commercial plans do this. Some still place biosimilars in higher tiers, even though they’re proven to be just as safe and effective. Always check your plan’s formulary for biosimilar coverage.

1 Comments

Write a comment